Commercial Mortgage Broker

Makenzie W. Campbell | $4B Closed

Commercial Mortgage Broker

Makenzie W. Campbell | $4B Closed | Slatt Capital | Vice President

Your Last CRE Deal Could Have Made You Millions More

But you didn’t know about the other financing options.

Here's What Your Bank Won't Tell You

@CREcapitalqueen

While you're reading this, your competitors are leveraging our network of 4,000+ active commercial real estate lenders to secure terms that would make your head spin.

YOU DESERVE TO KNOW ALL OF YOUR OPTIONS

Uncertainty is uncomfortable.

Borrowers are facing need vs want deadlines, forcing them to accept unfavorable terms from “relationship” lenders. Lenders are more in control today. Smart borrowers don’t say “hold off”, they ask “how can I get this done?”

The past 10 years of investing at ultra-low interest rates has skewed investor behavior, creating a false sense of hope that rates are going to drop back to those dramatically low levels.

hope is not a strategy.

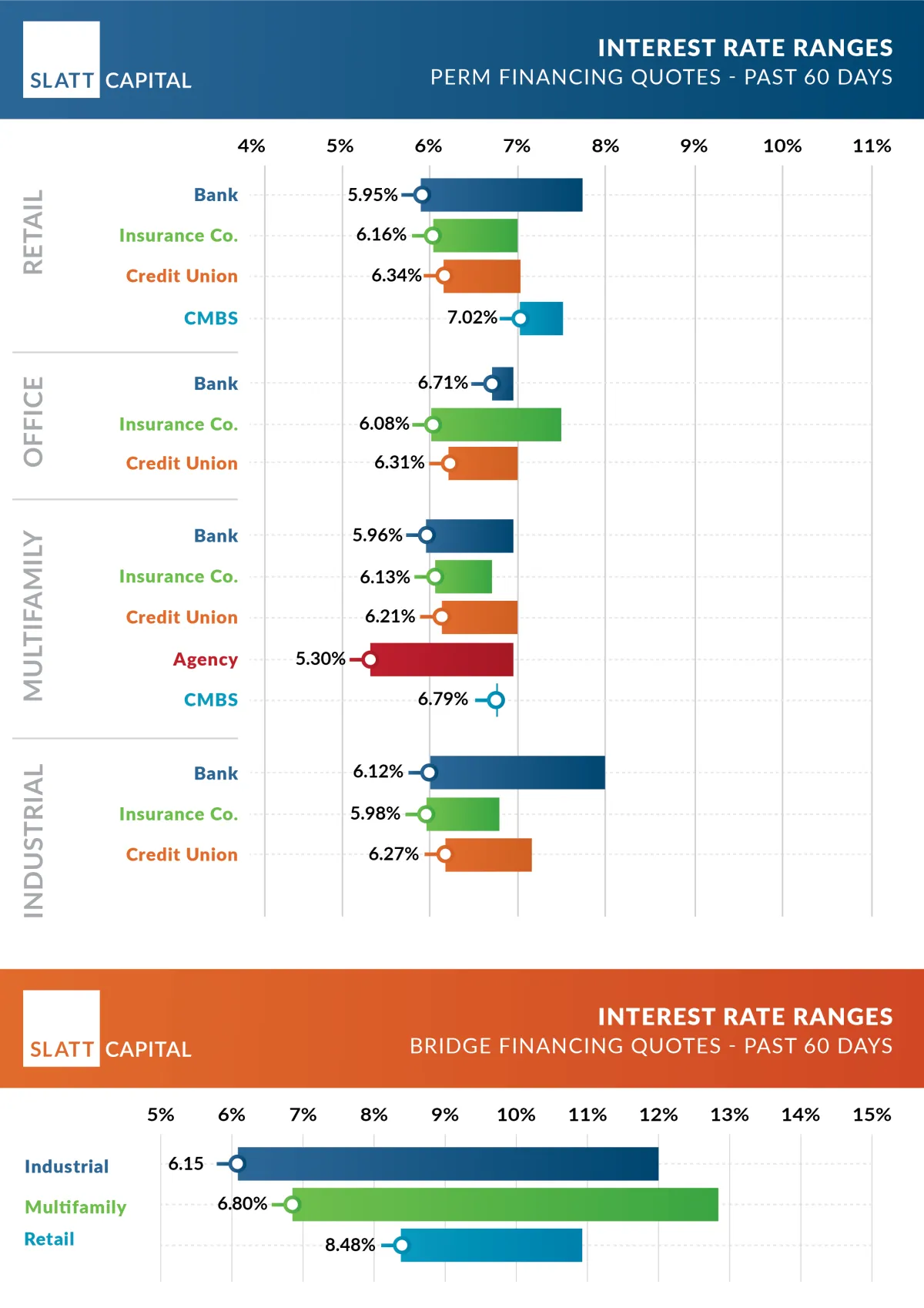

It’s called the “extend-and-pretend” approach and it is just a bandaid. You will pay now, or you will pay later. Let’s find a solution to minimize paying later at a lower cost now. Just look at what's possible in today's market:

Slatt Capital’s recent closings demonstrate what's actually available in commercial loan structures:

• BTR Bridge Refinance: $11.2 million / 70% LTV / 10.5% fixed rate / Interest Only / Non-recourse and with less than $10k closing costs and 1.5% lender fee (Feb 2025)

• Mixed Use Retail Portfolio Acquisition Perm debt: $8.5 million / 6.5% fixed rate, interest-only for 5 (Jan 2025)

• Multi tenant Industrial in Colorado Feb 2025): $4.8 million / 75% LTV / 6.5% rate / 5 year term / 25 year amort / full recourse

• SFR Scattered Rental Portfolio Refinance: $9 million / 60% LTV / 7.4% rate / 7 years Interest only / Non-recourse

Slatt Capital’s recent closings demonstrate what's actually available in commercial loan structures:

• BTR Bridge Refinance: $11.2 million / 70% LTV / 10.5% fixed rate / Interest Only / Non-recourse and with less than $10k closing costs and 1.5% lender fee (Feb 2025)

• Mixed Use Retail Portfolio Acquisition Perm debt: $8.5 million / 6.5% fixed rate, interest-only for 5 (Jan 2025)

• Multi tenant Industrial in Colorado Feb 2025): $4.8 million / 75% LTV / 6.5% rate / 5 year term / 25 year amort / full recourse

• SFR Scattered Rental Portfolio Refinance: $9 million / 60% LTV / 7.4% rate / 7 years Interest only / Non-recourse

Precision. Leverage. Opportunity

“I appreciate you reaching out after transitioning to Makenzie Campbell and building on the relationship—your persistence and creativity in working with us to prove the value paid off! I enjoyed working with you and, the closing team. The closing was smooth. Fees were as anticipated and well communicated. All were on task, and deadlines were met. Communication was consistent and often. Thanks for continuing to find ways to facilitate financing in all of [our family office’s endeavors. Keep striving to build new relationships while achieving higher leverage and reducing fees and interest rates!

I look forward to more opportunities to work together.”

- Family Office Borrower

The capital is out there – you just need to know where to look. By limiting yourself to a single lender or having a “kick-the-can” mentality, you're potentially leaving better terms on the table. Take the time to shop around and let lenders compete for your business.

Take Back Control—Your Capital, Your Terms

Makenzie Campbell specializes in

turning capital challenges into competitive advantages.

With access to a diverse network of lenders and creative financing solutions, she ensures you get the right deal, not just any deal.

Your Next 60 Seconds Could Be Worth Millions

Look, we get it. You have relationships. Your current lender "takes care of you." But do they show you what the entire market is offering? Do they tell you when their competitor is offering 50 basis points better? Of course not!!!!

The Hard Truth: Every day you're not working with an expert is a day you're potentially:

• Settling for inferior loan terms

• Overpaying by thousands in interest

• Relying on a black box execution process

• Partnering with a high-maintenance lender or servicer

• Letting your “relationship” get in the way of smart business decisions

• Missing out on higher leverage and lower closing cost opportunities